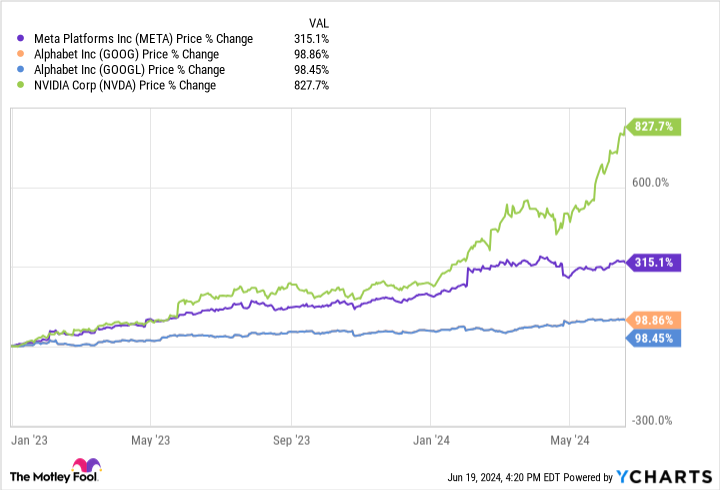

It’s difficult to obtain wide arrangement on much nowadays, as I make certain most of us see heading right into political election period. Yet one location of arrangement, a minimum of amongst billionaire hedge fund supervisors, is that buying huge technology supplies like Alphabet ( NASDAQ: GOOG)( NASDAQ: GOOGL), Meta Systems ( NASDAQ: META), and Nvidia ( NASDAQ: NVDA) is smart. It’s been profitable recently, with Nvidia blazing a trail, as revealed listed below.

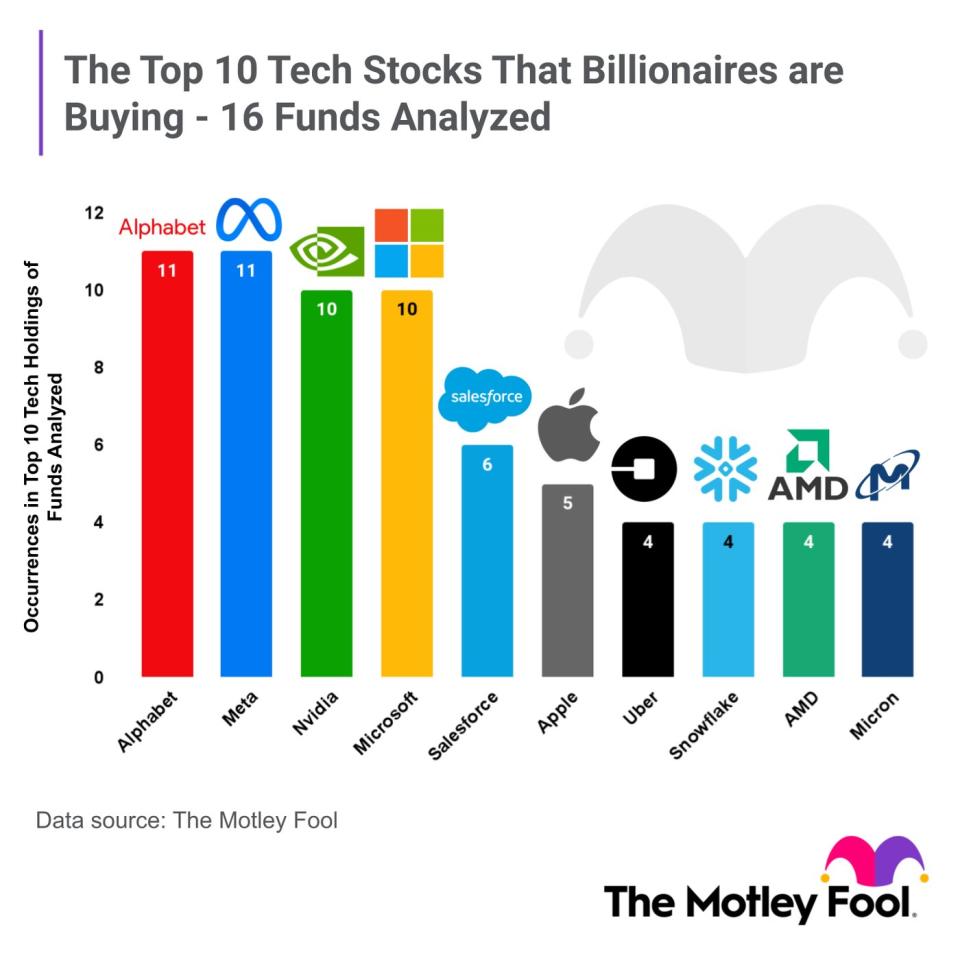

Of the 16 bush funds assessed by The , a minimum of 10 have the 3 supplies called over among their top 10 tech holdings (since the 4th quarter of 2023).

Below are some factors, so you can establish if they must additionally remain in your profile.

Alphabet

By diving right into its monetary outcomes, it’s very easy to see why Alphabet is a fave of hedge funds. In 2023, the firm generated $307 billion in profits and $84 billion in running revenue. It followed this up with $81 billion in profits and $25 billion in running revenue in the initial quarter, year-over-year gains of 15% and 46%, specifically. The 32% operating margin in the initial quarter is especially excellent. Yet possibly the very best top quality is its capability to produce capital.

Alphabet generated $102 billion in cash money from procedures (CFO) in 2023 and $29 billion in the initial quarter of 2024, placing it on speed to wreck the 2023 number. Cash money from procedures is an essential statistics since it demonstrates how a firm’s key organization carries out and just how much of the earnings transforms to cash money. Because CFO is also more than running revenue, it validates that Alphabet’s incomes are excellent quality.

It’s been years given that there was any type of real difficulty to Google Look’s supremacy. Nonetheless, the launch of ChatGPT and Microsoft’s financial investment in bringing it to Bing were wake-up telephone calls. Ever since, Alphabet has actually responded to with expert system (AI) devices of its very own. The firm has actually established them for many years, yet they are lastly concerning the marketplace.

Gemini is its most sophisticated generative-AI chatbot yet, able to respond to complicated questions, help with coding, and far more. As an example, if you wish to upgrade your return to, you can detail your experience and certifications and Gemini will certainly generate an example return to nearly immediately.

Alphabet’s existing price-to-earnings (P/E) proportion is 27, near to its five-year standard. With its incredible capital and proceeded development, the supply is an outstanding long-lasting financial investment.

Meta Systems

Meta, previously Facebook, is making a large press to lead the AI arms race. Meta AI is a huge language design (LLM) digital aide efficient in addressing difficult questions, addressing complicated issues, and various other features. It is Meta’s response to ChatGPT and is readily available on systems like Facebook, Carrier, Instagram, and WhatsApp.

At its heart, Meta is an advertising and marketing firm; 98% of first-quarter profits was from marketing. The even more individuals and even more time invested in its applications, the much more profits it will certainly make. Meta AI might maintain individuals from leaving the application for opponents, like ChatGPT or Google when searching for chatbot-type solutions.

Meta’s overall profits struck $36.5 billion in the initial quarter with excellent 27% year-over-year development. Running revenue jumped from $7.2 billion to $13.8 billion.

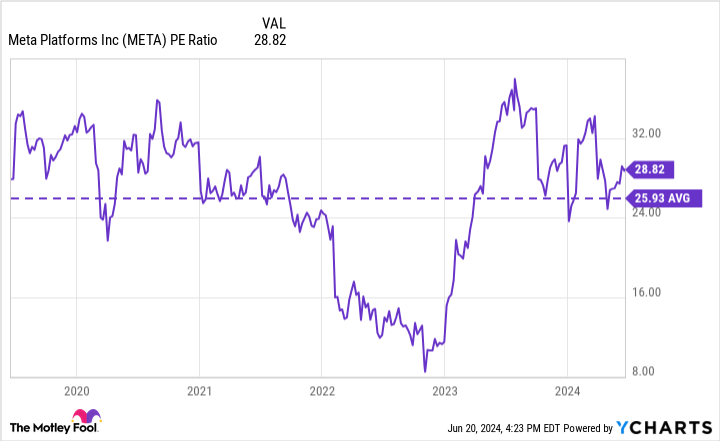

Tiger Global Monitoring seems Meta’s most significant follower, as 19% of its technology profile is devoted to its supply. Meta’s existing P/E proportion is a little more than its five-year standard; nevertheless, the standard is manipulated to the drawback by the supply’s substantial decrease in 2022, as revealed listed below.

This implies the supply is most likely near to its reasonable worth. Meta additionally presented its first-ever returns this year. The return is tiny currently, at much less than 1%, yet provided the firm’s success, it might increase dramatically in time. Meta’s current outcomes are fantastic, making it very easy to see why it is a billionaire fave.

Nvidia

Nvidia’s increase to end up being one of the most beneficial firm on earth is unbelievable, and it was improved our limitless cravings for information. Nvidia’s visuals handling devices (GPUs) and software program are critical parts for information facilities and are much more sought after because of the increase of AI.

Cloud software program, information handling and storage space, streaming solutions, and banking all rely upon information facilities to work. Supposed hyperscaler information facilities (several over 100,000 square feet) are anticipated to enhance by over 100 yearly for the following years, according to one resource, offering Nvidia with a lengthy path still.

Nvidia really did not let down in the initial quarter, uploading a 262% year-over-year boost in overall profits to $26 billion. Its information facility sales blew up once again to $23 billion, a 427% year-over-year boost. The 10-for-1 supply split additionally ecstatic capitalists, although supply divides have no straight result on the firm’s or investors’ worth.

Of the 16 billionaire profiles examined, Nvidia remains in the top-10 technology holdings of 10, with a number of having it in the leading 3. Nonetheless, brand-new capitalists in Nvidia must think about the evaluation prior to entering with both feet.

Its existing P/E is greater than 70. This goes down to 47 on an ahead basis yet still overshadows Microsoft‘s ( NASDAQ: MSFT) very own soaring evaluation.

Nvidia will certainly have a long, thriving future, yet think about dollar-cost averaging or waiting on a dip to build up shares currently.

Many billionaires really did not obtain well-off by mishap. These hedge funds research study information, employ market specialists, and make intelligent supply gets. While capitalists must not thoughtlessly follow their lead, analyzing their leading choices is a great location to obtain concepts.

Should you spend $1,000 in Alphabet now?

Prior to you acquire supply in Alphabet, consider this:

The Supply Expert expert group simply recognized what they think are the 10 best stocks for capitalists to acquire currently … and Alphabet had not been among them. The 10 supplies that made it might generate beast returns in the coming years.

Think About when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $775,568! *

Supply Expert offers capitalists with an easy-to-follow plan for success, consisting of advice on developing a profile, routine updates from experts, and 2 brand-new supply choices monthly. The Supply Expert solution has greater than quadrupled the return of S&P 500 given that 2002 *.

* Supply Expert returns since June 24, 2024

Suzanne Frey, an exec at Alphabet, belongs to The ‘s board of supervisors. Randi Zuckerberg, a previous supervisor of market advancement and spokesperson for Facebook and sis to Meta Operating systems Chief Executive Officer Mark Zuckerberg, belongs to The ‘s board of supervisors. Bradley Guichard has placements in Alphabet and Nvidia. The has placements in and suggests Alphabet, Meta Operatings Systems, Microsoft, and Nvidia. The suggests the adhering to alternatives: lengthy January 2026 $395 get in touch with Microsoft and brief January 2026 $405 get in touch with Microsoft. The has a disclosure policy.

Alphabet, Meta, and Nvidia: 3 Tech Stocks Beloved by Billionaires was initially released by The

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.