In an analysis shared by means of X, Alex Thorn, the head of research study at Galaxy Digital, has actually forecasted that the Bitcoin market might deal with much less offer stress than prepared for from the resolution of the Mt. Gox personal bankruptcy instance. With circulations of Bitcoin (BTC) and Bitcoin Cash Money (BCH) to financial institutions slated to begin in July, this notes completion of a decade-long lawful experience coming from among one of the most disastrous losses in the background of cryptocurrency.

Mt. Gox was when among the biggest cryptocurrency exchanges, taking care of over 70% of all Bitcoin deals at its optimal. Its failure started with the discovery in 2014 that roughly 940,000 BTC (worth regarding $424 million at the time) were missing out on from its safes, assumed swiped or lost. This caused the exchange’s personal bankruptcy and a long term lawful and management fight to recuperate the shed properties. Throughout the years, 141,868 BTC were recuperated, which, as a result of Bitcoin’s cost boost, are currently valued at roughly $9 billion.

Why Mt. Gox’s Bitcoin Marketing Stress Might Be Means Overestimated

Thorn’s understandings are based in a comprehensive testimonial of personal bankruptcy filings and discussions with the financial institutions included. He kept in mind that while the initial loss was considerable, the healing procedure has actually generated a substantial return for financial institutions in buck terms– a 140-fold boost based upon present evaluations.

In his evaluation, Thorn detailed that the “very early payment” alternative readily available to financial institutions includes a 10% decrease however has actually been chosen by roughly 75% of them, likely as a result of the extended nature of the process. This leaves around 95,000 BTC for very early circulation. From this, 20,000 BTC are alloted to cases funds, and 10,000 BTC are alloted for the resolution of the Bitcoinica personal bankruptcy, minimizing the number readily available to specific financial institutions to roughly 65,000 BTC/BCH.

Thorn forecasts that most of specific financial institutions, a number of whom are veteran Bitcoin lovers and very early adopters, are most likely to preserve their shares instead of offer. He indicates their previous actions, especially their resistance to “engaging & & hostile deals” from cases funds, as a measure of their most likely purposes. Thorn stressed the substantial resources gains effect that marketing would certainly carry these financial institutions, which might discourage the instant liquidation of their properties.

Also if a tiny portion (10%) of the 65,000 BTC were to be marketed, it would certainly equate to around 6,500 BTC possibly getting in the marketplace. This number is significantly less than some market speculators have actually been afraid. Thorn expects that these deals will certainly be taken in by the market without considerable interruption, as a result of the durable liquidity of Bitcoin on significant exchanges like Sea serpent and Bitstamp where these deals are most likely to happen.

Thorn additionally highlighted the specific difficulties encountering Bitcoin Cash money, which was not initially possessed by the financial institutions however entered their belongings via the BTC fork in 2017. With substantially reduced liquidity and market deepness contrasted to Bitcoin, BCH is positioned to deal with better volatility. He mentioned that BCH has just $400,000 liquidity on order publications within 1% of the present market value, which might worsen cost motions as financial institutions start to offer their holdings.

Thorn’s thorough evaluation recommends a modest market effect from the Mt. Gox circulations, with a lower-than-expected quantity of Bitcoin striking the marketplace and a possibly better percentage of Bitcoin Cash money being marketed. He suggests that stakeholders keep track of purchase motions carefully, especially via systems like Arkham Knowledge, to track the real-time effect as these circulations start.

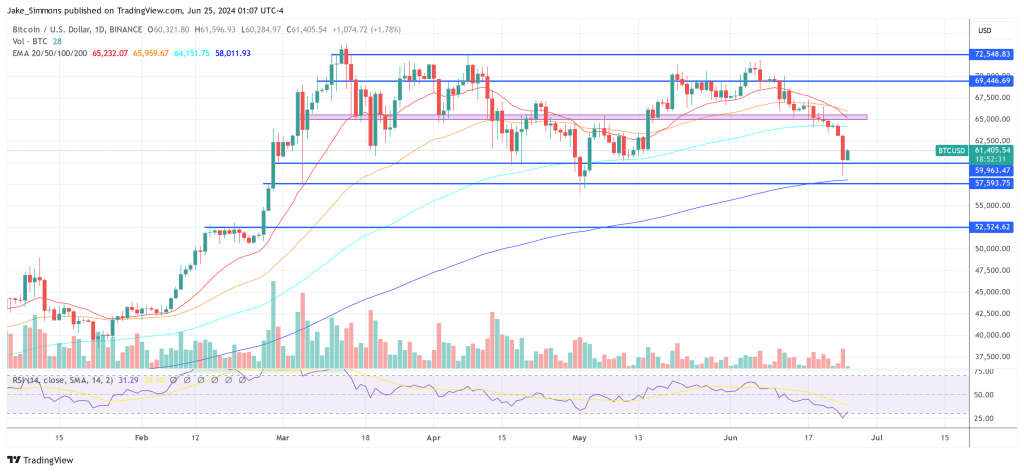

At press time, BTC traded at $61,405.

Included photo developed with DALL · E, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.