Information reveals the view amongst the Bitcoin capitalists has actually left the greed area adhering to the most up to date collision in the possession listed below $61,000.

Bitcoin Concern & & Greed Index Is Currently Resting Inside The Neutral Area

The “Concern & & Greed Index” is a sign developed by Alternative that informs us regarding the typical view that the investors in the Bitcoin and broader cryptocurrency market share today.

This index thinks about the information of 5 variables to identify this view: volatility, trading quantity, social media sites view, market cap prominence, and Google Trends.

To stand for the view, the sign utilizes a range that ranges from no to a hundred. All worths listed below the 47 mark recommend the existence of worry amongst the capitalists, while those over 53 symbolize greed on the market.

The area is in-between these 2 areas normally comes from the neutral mindset. The Bitcoin Concern & & Greed Index seems inside this 3rd area.

The worth of the statistics appears to be 51 currently|Resource: Alternative

As shows up over, the Concern & & Greed Index is 51 today. This is a significant modification from the worth of 55 seen the other day, as the marketplace had actually held a view of greed after that.

The aggravating view is since cryptocurrency costs have actually encountered solid bearish energy in the previous 24 hr. This decrease in the statistics remains in line with the pattern from the previous week, as the most up to date drawdown in the possession is simply an extension of the current bearish pattern.

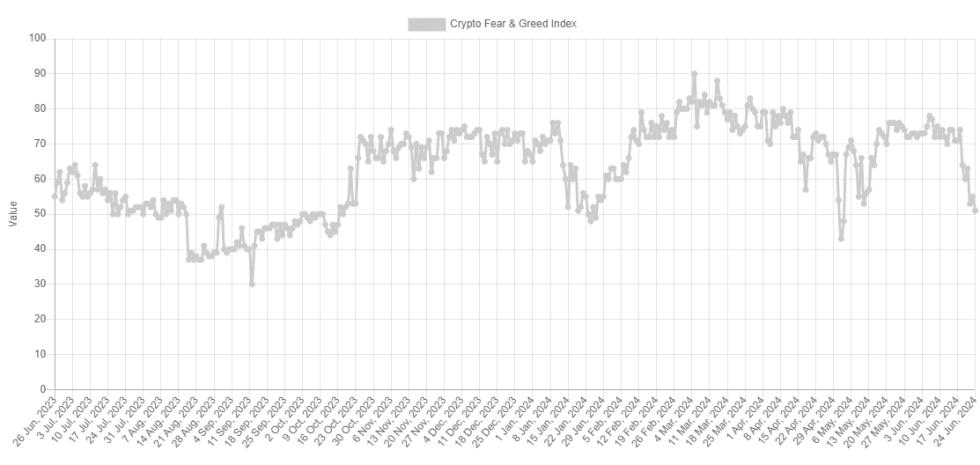

The graph listed below demonstrate how the Bitcoin Concern & & Greed Index has actually seen its worth modification throughout the previous year.

Resembles the worth of the statistics has actually been greatly dropping in current days|Resource: Alternative

As appears from the chart, the most up to date decrease in the Bitcoin Concern & & Greed Index has actually been rather sharp. On 18 June, at the beginning of this dive, the statistics had a worth of 74, which was quite deep right into the greed area.

This worth was right on the side of the “regular” greed area, as over 75, the sign begins mirroring the existence of “severe greed” amongst the capitalists. Historically, this area has actually been rather essential for the cryptocurrency.

This is since the cost of the possession has a tendency to relocate versus the assumptions of the bulk, and the opportunities of such an in contrast step rising, the more powerful this assumption comes to be.

In the severe greed area, the capitalists experience bliss; therefore, a top in the possession comes to be even more most likely to occur. The all-time high (ATH) in the possession back in March likewise happened when the index was inside this area.

While severe greed can cause adjustments in the possession, “severe worry,” which occurs under 25, can assist the cryptocurrency reach bases rather. Nonetheless, the sign has a tendency to remain inside or near the greed area throughout advancing market.

Hence, while the view hasn’t rather aggravated right into the severe worry or perhaps the worry area with the most up to date dive, the truth that it has actually cooled down to neutral can still be a positive indication for the coin to get to an end to its decrease, presuming a favorable pattern continues to be the leading pressure in the lasting.

BTC Rate

At the time of composing, Bitcoin is drifting about $60,300, down greater than 10% over the previous week.

The cost of the coin shows up to have actually seen a high decrease in the previous day|Resource: BTCUSD on TradingView

Included picture from Dall-E, Alternative.me, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.