Based upon on-chain information, the Head of Research study at the analytics company CryptoQuant has actually described exactly how Bitcoin has actually been looking much less favorable lately.

Bitcoin Bull-Bear Market Cycle Sign Has Actually Seen A Decrease Just Recently

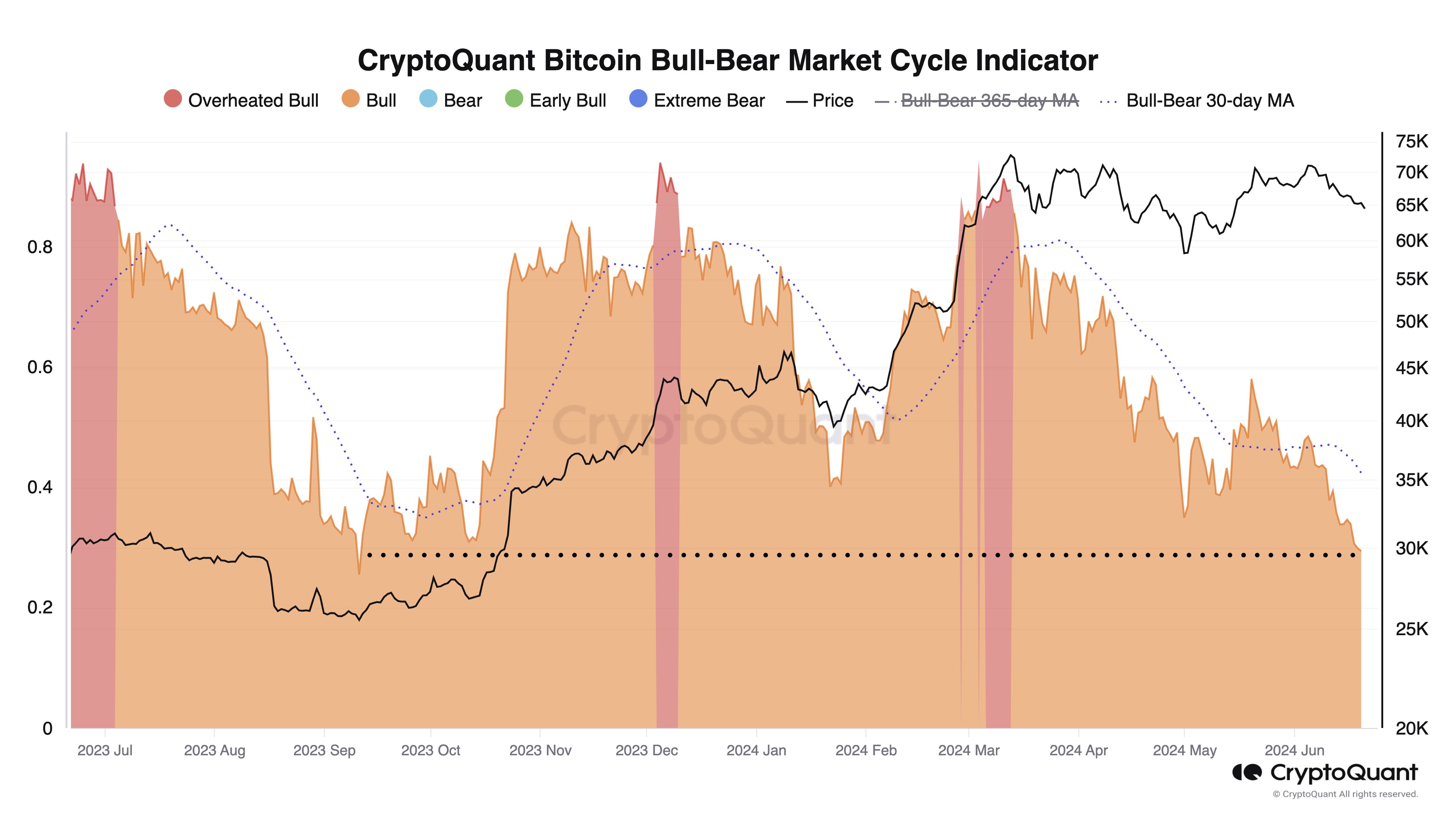

In a brand-new post on X, CryptoQuant Head of Research study Julio Moreno shared what the current fad in the Bitcoin Bull-Bear Market Cycle Sign has actually been resembling. This sign is based upon an additional statistics established by the analytics company: the P&L Index.

The P&L Index is an assessment sign for Bitcoin that might figure out whether the coin’s cost is underestimated or misestimated. This statistics combines the information of 3 prominent signs associated with benefit and loss to discover its worth (MVRV Proportion, NUPL, and SOPR).

Historically, the P&L Index’s communications with its 365-day relocating standard (MA) have actually brought some relevance for the cryptocurrency. A cross for the sign over this line has actually indicated a change to a bull stage, while a decrease listed below has actually suggested a shift to a bearish program.

Currently, what the Bitcoin Bull-Bear Market Cycle Sign, the real metric of rate of interest right here, does is that it takes the P&L Index and determines its range from this vital MA.

When the worth of this sign is above absolutely no, it recommends BTC remains in an advancing market, as the P&L Sign is over its 365-day MA. Likewise, the statistics thinking an unfavorable worth suggests an energetic bearish market.

Below is the graph for this CryptoQuant sign over the previous year:

The worth of the sign shows up to have actually been dropping over the last couple of months|Resource: @jjcmoreno on X

The over chart reveals that the Bitcoin Bull-Bear Market Cycle Sign fired high throughout the rally, resulting in a brand-new all-time high (ATH).

Normally, the greater the metric’s worth, the even more overpriced the possession might be thought about. Throughout the ATH break, the sign acquired degrees related to an “overheated bull,” which might be why the cryptocurrency struck a leading at that time.

Because the cryptocurrency has actually combined, the sign’s worth has actually cooled down. It’s still over the absolutely no degree, indicating that BTC remains in an advancing market, however the coin has actually come to be much less warm. “The Bitcoin market is the least favorable considering that September 2023,” keeps in mind Moreno.

In September 2023, the possession was relocating sidewards around lows, and this combination ultimately resulted in fresh favorable energy. Thus, the sign cooling down might not misbehave for the possession.

It continues to be to be seen, however, whether the sign has actually completed its drawdown or if it will certainly go across right into the adverse region. In such a situation, the marketplace would certainly have transitioned in the direction of a bearish one rather.

BTC Rate

At the time of composing, Bitcoin is trading at around $61,600, down greater than 5% over the previous week.

Resembles the cost of the coin has actually been moving off in current days|Resource: BTCUSD on TradingView

Included photo from Dall-E, CryptoQuant.com, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.