This month of June has actually been one to neglect for Bitcoin and its financiers, with the front runner crypto experiencing substantial cost decreases. A current advancement reveals that Bitcoin miners were greatly in charge of these cost goes down with a wave of sell-offs from them.

Bitcoin Miners Cost A Worrying Price

Market Knowledge system IntoTheBlock exposed in an X (previously Twitter) post that Bitcoin miners have actually marketed over 30,000 BTC ($ 2 billion). This is the fastest speed in over a year at which these miners have actually unloaded their BTC holdings. IntoTheBlock included that this wave of sell-offs has actually been triggered by the current cutting in half occasion, which has actually tightened up the revenue margins of these miners.

This last cutting in half occasion saw miners’ incentives cut in half from 6.25 BTC to 3.125 BTC, which has actually eventually impacted their earnings and productivity. Bitcoin’s lukewarm cost activity because striking a brand-new all-time high (ATH) in March has actually additionally not aided, with these miners aiming to have actually prioritized their prompt economic security as opposed to expecting even more cost recognition from Bitcoin.

This has actually triggered these miners to unload a considerable quantity of their holdings, specifically to cover functional expenses. Nevertheless, BTC needs to birth the impact of these miners’ capitulation, seeing exactly how the front runner crypto has actually decreased from around $70,000 at the beginning of the month to listed below $63,000 at the time of creating.

Crypto expert Willy Woo additionally lately highlighted the value of these sell-offs from miners on Bitcoin, specifying that the front runner crypto will just recuperate when the “ weak miners pass away and hash price recuperates.” He clarified that cleaning weak hands would certainly include the ineffective miners entering into insolvency while various other miners would certainly be compelled to update their equipment to a lot more reliable ones.

Whatever occurs, BTC’s cost is anticipated to make a remarkable healing once these miners are liquidating their holdings. Nevertheless, in the meanwhile, Bitcoin dangers better decreasing and going down listed below the emotional degree of $60,000 if this enormous marketing stress from the miners lingers.

An Additional Reason That BTC Threats A More Drop

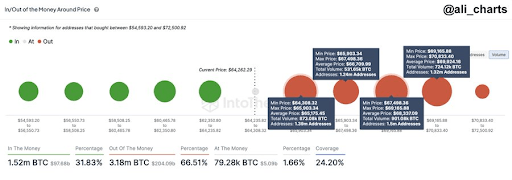

Crypto expert Ali Martinez lately pointed out that around 5.45 million addresses acquired 3.03 million BTC in between $64,300 and $70,800. He included that that variety creates a considerable supply obstacle, with BTC taking the chance of a “high improvement.” Martinez specified that those owners that purchased that variety might unload their holdings to restrict their losses, which might better escalate the descending stress on Bitcoin.

Bitcoinist additionally lately reported that Bitcoin had actually gone down listed below the temporary owners’ recognized revenue of $66,200. This is substantial as BTC’s failing to rebound quickly sufficient might require this classification of financiers to reduce their losses or safe whatever little revenue they have actually left from their Bitcoin financial investment.

Included picture produced with Dall.E, graph from Tradingview.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.