The technology market has actually provided remarkable development over the previous year. The S&P 500 has actually struck document highs numerous times, sustained mainly by capitalists’ enjoyment over this sector. Nonetheless, regardless of its huge lasting possibility, one business has actually been glaringly omitted of the rally.

Shares in Intel ( NASDAQ: INTC) have actually dived 38% given that Jan. 1, showing a loss of belief from Wall surface Road. Over the last years, the business has actually encountered duplicated difficulties, consisting of shed market share in main handling systems (CPUs), a financial slump in 2022 that caused high economic decreases, and expensive restructuring.

Yet, current quarterly profits and a change in its organization version recommend a recuperation can be underway for Intel. Development in the business’s totally free capital and a development in its production department can lead to a profitable future for the chipmaker, with currently possibly your possibility to participate the very beginning.

So, below’s why Intel is a shrieking buy this June.

Providing affordable price-to-performance in AI chips

All eyes have actually gotten on chip supplies this year along with a boom in expert system (AI). High-powered chips like graphics processing units (GPUs) can running the extensive work that go along with training AI designs. Because of this, GPU need has actually escalated over the in 2015, which has actually seen market leader Nvidia‘s supply and profits likewise broaden. Its share cost has actually increased 210% in the last twelve month.

Nvidia’s success has actually inspired various other chip business to introduce contending AI items, consisting of Intel. Previously this year, Intel debuted its Gaudi 3 accelerator, assuring “50% generally far better reasoning and 40% generally far better power performance than Nvidia H100– at a portion of the expense.”

According to Tom’s Equipment, Intel’s Gaudi 3 chips set you back regarding $15,650, approximately fifty percent of Nvidia’s H100 for $30,000. As an underdog out there, Intel is trying to damage Nvidia and bring in business to its equipment. If the business can use affordable price-to-performance, it can have a respectable possibility at accomplishing a profitable function in the budding AI industry.

Intel is repossessing the leading place in production

Intel was when the greatest name in chip production yet lost to Taiwan Semiconductor Production simply over a years earlier. Nonetheless, current headwinds have actually compelled Intel to reassess its organization version and reprioritize the factory sector.

Allied Marketing research reveals the semiconductor factory market was valued at $107 billion in 2022 and is forecasted to greater than dual to $232 billion by 2032. At the same time, Intel is sinking billions right into opening up chip plants throughout the united state and abroad.

The business has actually brought in famous capitalists in its endeavor, consisting of personal equity company Beauty, Brookfield Framework, and the united state federal government as a leading recipient in Head of state Biden’s CHIPs Act– an effort developed to broaden the united state’s factory ability.

Intel’s concern on producing enhances its expectation in AI as it possibly establishes it in addition to business like Nvidia and AMD, which are primarily concentrated on style. Intel’s change to a shop version can see it come to be a leading AI chip supplier, benefiting from raised need throughout the sector.

chief executive officer Rub Gelsinger claimed previously this month that the business intends to construct “everyone’s AI chips” and anticipates its coming Ohio plant to come to be the AI fab of the country.

Production takes a substantial financial investment upfront, showing it can take years prior to Intel starts appreciating the fruit of its labors. Nonetheless, the relocation can make its supply a superb lasting buy, particularly currently while it’s trading at one of its least expensive costs in years.

Among the best-valued means to buy AI

The AI market’s speedy surge has actually inflated supplies throughout the sector, increasing the cost of access for brand-new capitalists. Nonetheless, Intel’s current dip can make its supply a deal buy.

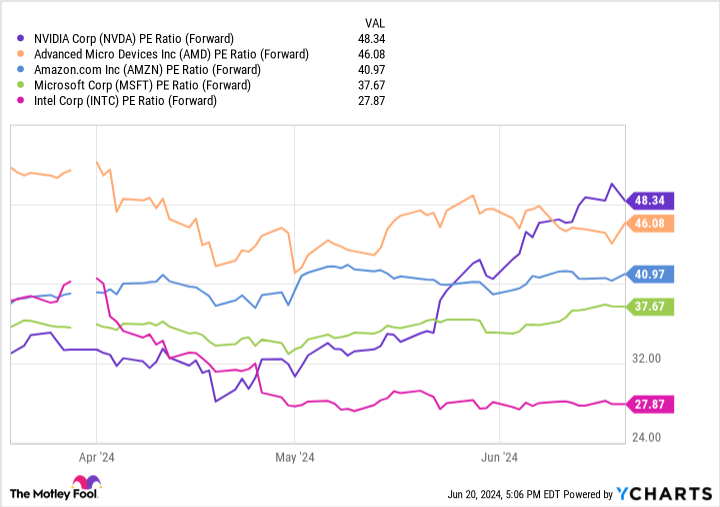

This graph reveals Intel might be the best-valued supply in AI. The chipmaker’s ahead price-to-earnings proportion is the most affordable amongst these business, showing its supply supplies one of the most worth.

With its large possibility in AI and a production organization that can increase profits for several years, Intel’s supply is a piece of cake today.

Should you spend $1,000 in Intel today?

Prior to you acquire supply in Intel, consider this:

The Supply Expert expert group simply recognized what they think are the 10 best stocks for capitalists to acquire currently … and Intel had not been among them. The 10 supplies that made it can create beast returns in the coming years.

Think About when Nvidia made this checklist on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $775,568! *

Supply Expert supplies capitalists with an easy-to-follow plan for success, consisting of support on constructing a profile, routine updates from experts, and 2 brand-new supply choices monthly. The Supply Expert solution has greater than quadrupled the return of S&P 500 given that 2002 *.

* Supply Expert returns since June 10, 2024

John Mackey, previous chief executive officer of Whole Foods Market, an Amazon subsidiary, belongs to The ‘s board of supervisors. Dani Cook has no setting in any one of the supplies pointed out. The has placements in and suggests Advanced Micro Instruments, Amazon, Microsoft, Nvidia, and Taiwan Semiconductor Production. The suggests Brookfield Framework Allies and Intel and suggests the complying with alternatives: lengthy January 2025 $45 get in touch with Intel, lengthy January 2026 $395 get in touch with Microsoft, brief August 2024 $35 get in touch with Intel, and brief January 2026 $405 get in touch with Microsoft. The has a disclosure policy.

Is Intel Stock a Buy? was initially released by The

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.