International financial large Basic Chartered is going into the crypto room with a brand-new area trading workdesk for Bitcoin and Ethereum, as exposed in a Bloombergreport This advancement placements Basic Chartered as one of the initial significant international financial institutions to involve straight in the trading of the underlying crypto possessions, a location that has actually seen careful engagement from significant international financial institutions largely as a result of strict regulative landscapes.

Basic Chartered Will Deal Bitcoin And Ethereum

The recently developed trading workdesk is incorporated within the financial institution’s forex (FX) trading system and is tactically placed in London, a worldwide monetary center, resources with understanding of the circumstance reported. This procedure is readied to start imminently, making Basic Chartered among the initial significant international financial institutions to help with area trading on real Bitcoin and Ether possessions, deviating from the much more typically traded crypto by-products.

The choice to release a place crypto trading workdesk comes from a precise duration of preparation and regulative appointments. “We have actually been functioning carefully with our regulatory authorities to sustain need from our institutional customers to trade Bitcoin and Ethereum, according to our approach to sustain customers throughout the broader electronic property community, from gain access to and custodianship to tokenization and interoperability,” the financial institution shared via a main declaration.

This effort is not Basic Chartered’s initial venture right into the electronic possessions room. The financial institution has actually proactively joined the cryptocurrency industry via considerable financial investments in associated facilities, such as Zodia Guardianship and Zodia Markets, which offer solutions varying from electronic property custodianship to advanced non-prescription trading options.

More broadening its blockchain ventures, Criterion Chartered introduced Libeara, a committed blockchain system targeted at helping organizations in tokenizing typical possessions. Significantly, this consists of an ingenious task for the development of a tokenized federal government mutual fund denominated in Singaporean bucks, showing the financial institution’s dedication to incorporating blockchain modern technology with standard monetary tools.

Past the functional information of the trading workdesk, the financial institution’s involvement with the crypto market is likewise shown in its market evaluation and projections. Just Recently, Criterion Chartered’s experts, consisting of Geoffrey Kendrick that leads arising marketing researches, released a noticeably hopeful forecast for Bitcoin’s rate trajectory, especially in the context of the upcoming United States governmental political elections.

” As we come close to the United States political election, I anticipate $100,000 to be gotten to and afterwards $150,000 by year-end when it comes to a Trump success,” Kendrick mentioned, recommending that political results can substantially affect market characteristics.

In the longer term, Kendrick visualizes Bitcoin getting to as high as $200,000 by the end of 2025, driven by durable and constant financial investment inflows right into recently introduced Bitcoin area ETFs, which he thinks will certainly draw in continual pension-type financial investments.

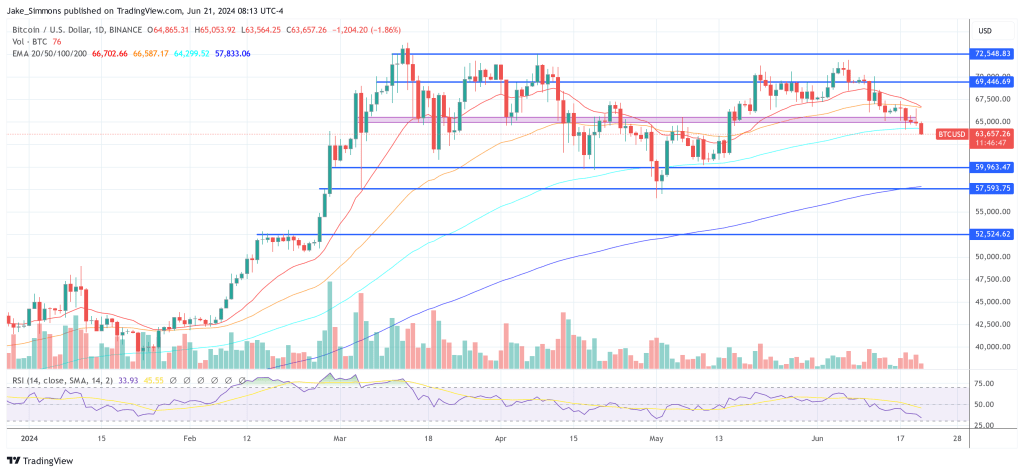

At press time, BTC traded at $63,657.

Included photo from X @BTC_Archive, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.