On Thursday, 3iQ Digital Property Administration announced the declaring of an initial program for The Solana Fund (QSOL) with safety and securities regulative authorities throughout Canada, omitting Quebec. If accepted, QSOL will certainly end up being the very first Solana (SOL) exchange-traded item (ETP) noted in The United States and Canada, trading on the Toronto Stock Market (TSX) under the ticker “QSOL”.

Very First Solana ETP In The United States And Canada Submitted

This possible listing notes a substantial landmark for 3iQ, an international leader in electronic property financial investment options. The company has a durable background of firsts in the electronic property field, consisting of introducing the very first openly traded Bitcoin and Ether funds in Canada.

QSOL intends to supply capitalists direct exposure to the electronic money SOL, the day-to-day rate activities of SOL in United States bucks, and the chance for long-lasting funding recognition. Furthermore, the fund will certainly take advantage of betting returns from the Solana network, approximated to variety in between 6-8%.

Greg Benhaim, Exec Vice Head Of State of Item and Head of Trading at 3iQ, highlighted the business’s dedication to technology and regulative conformity: “3iQ looks for to establish an international criterion of quality and we’re happy to function very closely with the OSC to properly improve the electronic property financial investment landscape in Canada.”

3iQ has actually partnered with Canaccord Genuity as the representative for the offering, while Tetra Depend On and Coinbase Wardship Depend On Firm, LLC will certainly work as custodians. The fund will certainly additionally make use of Coinbase Wardship’s institutional betting facilities, which is vital for sustaining SOL betting.

The launch of QSOL is prepared for to offer a controlled financial investment automobile, personifying the highest possible criteria, for both private and institutional capitalists. This growth lines up with 3iQ’s goal to supply easily accessible crypto property financial investment choices.

While this is a very first for The United States and Canada, Solana ETPs have actually currently made their mark worldwide. Products like the 21Shares Solana Laying ETP and the And So On Team Physical Solana item in Europe stand for over $1 billion in possessions. The authorization and succeeding success of QSOL might lead the way for additional Solana-based financial investment items in The United States and Canada.

James Seyffart, Bloomberg ETF expert, noted the relevance of Canada’s modern position on cryptocurrency ETFs: “Canada had place Bitcoin and place Ethereum ETFs prior to the United States also obtained futures ETFs for either property.”

Nevertheless, Seyffart additionally highlighted that this isn’t an Exchange Traded Fund (ETF), specifying, “I was incorrect. This is a Shut End Fund. So it would certainly be extra comparable to among the Grayscale depend on items. Other than Canada’s shut end funds have systems to stop the discount rates or costs from obtaining also severe. 3iQ did this with a Bitcoin fund in 2019 prior to introducing ETFs There is additionally no warranty that this point will certainly introduce. It’s simply been submitted.”

Established In 2012, 3iQ has actually developed itself as an introducing pressure in electronic property administration. The business uses a variety of financial investment items, consisting of The Bitcoin Fund (TSX: QBTC) and The Ether Fund (TSX: QETH), with considerable internet possessions. The Bitcoin ETF (BTCQ) and the Ether Laying ETF (ETHQ) are amongst its front runner items, showing the company’s devotion to supplying cutting-edge and controlled electronic property options.

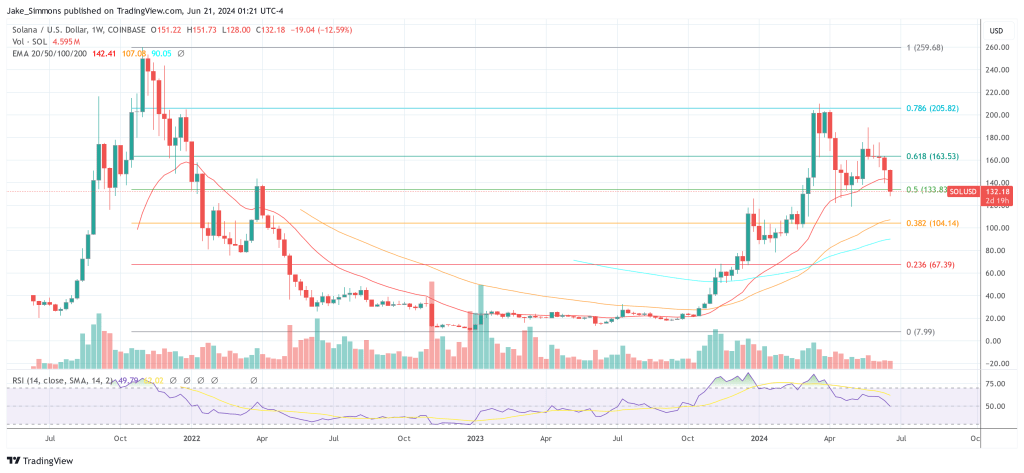

At press time, SOL traded at $132.

Included picture developed with DALL · E, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.