With the Federal Reserve making no clear dedication to when an interest rate cut may come, homebuilders are downsizing.

In Might, independently possessed housing starts was up to a seasonally readjusted price of 1.277 million systems, down 5.5% month over month and 19.3% contrasted to a year earlier, according to data launched Thursday by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development ( HUD).

An annualized decrease of 51.7% in multifamily real estate beginnings, which was up to a speed of 278,000 systems, is mostly at fault for the large annual reduction in overall beginnings. Yet single-family real estate beginnings additionally decreased to 982,000 systems, a 1.7% year-over-year reduction.

Sector specialists associated the huge annual decrease in multifamily beginnings to the currently high variety of apartment being finished, which resulting in an easing of rent price growth.

” Home builders remain in an ‘if you develop them, they will not come,’ market, as proceeded high home mortgage prices maintain even more possible customers out of the marketplace,” Robert Frick, a business economic expert at Navy Federal Credit Union, claimed in a declaration.

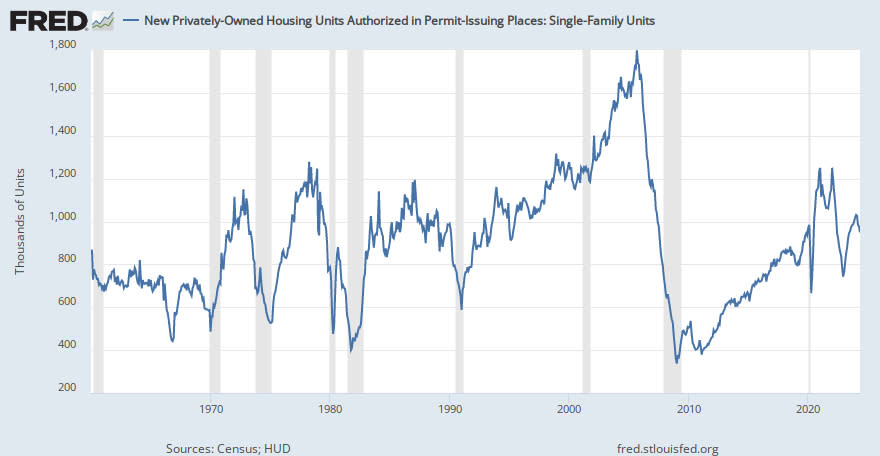

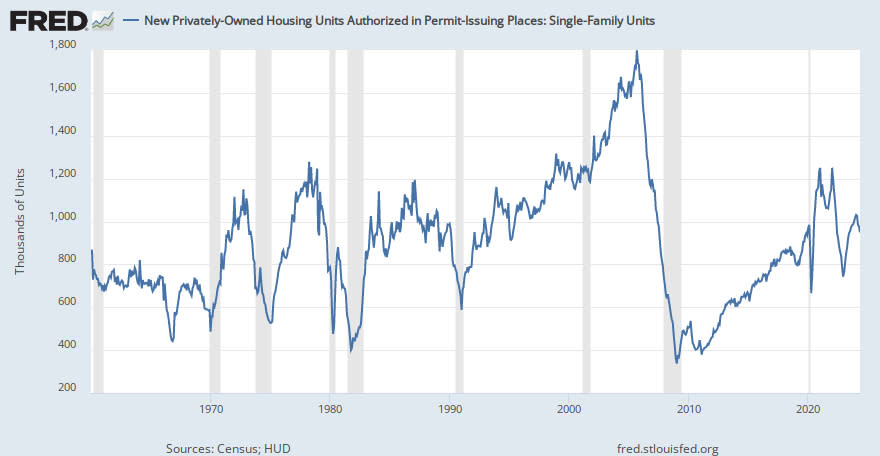

The variety of structure allows released in Might additionally uploaded month-to-month and annual decreases, being up to a seasonally readjusted yearly price of 1.386 million systems, down 3.8% month over month and 9.5% year over year.

Once again, the multifamily market is mostly at fault, as it went down to 382,000 systems, down 6.1% from April and 31.4% from a year earlier. The multifamily market’s huge annual decrease was partly countered by a 3.4% yearly rise in the single-family market (to 949,000 systems), yet this was down 2.9% from April.

One intense area in the record was the variety of conclusions, which climbed 1% year over year to 1.514 million systems. In spite of the rise, this was still down 8.4% from a month prior. The single-family (1.027 million systems finished) and the multifamily industries (479,000 systems finished) each taped comparable patterns, with the single-family sector uploading an 8.5% month-to-month reduction and a 2% yearly rise, while the multifamily sector was down 7.2% month over month and up 0.8% year over year.

” Home builders remain to include in the supply matter. In Might, single-family home conclusions were still about 1% greater than a year earlier,” Orphe Divounguy, Zillow elderly economic expert, claimed in a declaration. “With even more homes beginning the marketplace and no similarly huge uptick in real estate sales, overall for-sale real estate supply is greater than it was a year earlier.”

On a local degree, the Midwest uploaded the biggest month-to-month decrease in real estate beginnings, going down 19% to 149,000 systems. The Northeast (77,000 systems) and South (733,000 systems) additionally taped month-over-month decreases of 2.5% and 8.5%, specifically. The West uploaded the only month-to-month rise, leaping 10.4% from April to 318,000 systems. Year over year, all 4 areas recoded decreases, with the Midwest uploading the biggest decrease at 43.1% and the West reporting the tiniest at 9.4%.

The decrease in real estate begins comes as homebuilder sentiment was up to its cheapest analysis given that December 2023. The National Association of Home Builders ( NAHB)/ Wells Fargo Real Estate Market Index (HMI) dropped 2 factors month over month to an analysis of 43 in June. This is the second consecutive month of decreases.

The record associates the decrease to “constantly high” home mortgage prices that are maintaining customers on the sidelines.

” Home building contractors are additionally taking care of greater prices for building and growth finances, persistent labor scarcities and a lack of buildable great deals,” NAHB Chairman Carl Harris claimed in a declaration.

The NAHB/HMI record is based upon a month-to-month study of NAHB participants (commonly local and regional homebuilders) in which building contractors are asked to price both existing market problems for new-home sales and anticipated problems for the following 6 months, along with the website traffic of possible new-home customers.

Ratings for each and every part of the homebuilder self-confidence study are after that utilized to determine an index, with a number higher than 50 suggesting that even more homebuilders see problems as positive than not.

As building contractors battled to offer homes in June, the share of building contractors reducing home rates climbed to 29%, up from 25% in Might. It was additionally the biggest share given that January 2024, when 31% of building contractors reported reducing rates. While even more building contractors are reducing rates, the ordinary rate decrease continues to be at 6%, the like it has actually been for the previous year.

Generally, the use of sales motivations depended on 61% in June, contrasted to 59% in Might. In addition, this is the greatest share of building contractors making use of sales motivations given that January 2024 (62%).

The NAHB reported that homebuilders’ scale of existing sales problems dropped 3 indicate 48. The scale determining website traffic of possible customers reduced 2 indicate 28, while the part charting sales assumptions over the following 6 months uploaded a four-point decrease to 47. This is the very first time all 3 metrics have actually been listed below 50 given that December 2023.

” We remain in an uncommon scenario due to the fact that an absence of progression on minimizing sanctuary rising cost of living, which is presently going for a 5.4% year-over-year price, is making it challenging for the Federal Get to attain its target rising cost of living price of 2%,” NAHB primary economic expert Robert Dietz claimed in a declaration. “The very best means to lower sanctuary rising cost of living and press the total rising cost of living price to the 2% variety is to boost the country’s real estate supply. An extra positive rate of interest atmosphere for building and growth finances would certainly aid to attain this objective.”

Regionally, the three-month relocating standards for the HMI dropped month over month in 3 of the 4 areas, with the West going down 2 indicate an analysis of 41, the South lowering by 3 indicate 46, and the Midwest shedding 3 factors for an analysis of 47. The Northeast held consistent from the previous month at an analysis of 62.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.